Are you looking to delve into the world of copy trading but don’t know where to start? Look no further! With Deriv’s innovative cTrader platform, copy trading has never been easier. Whether you’re a seasoned trader or just starting out, our step-by-step guide will help you navigate the exciting world of copy trading.

OPEN ACCOUNT HERE Deriv cTrader

Understanding Copy Trading

Copy trading allows you to replicate the trades of experienced traders, known as strategy providers, in real-time. With Deriv cTrader, you have access to a diverse range of global financial markets, including forex, ETFs, stocks, and indices, as well as derived indices, available 24/7. Let’s dive into how you can get started.

Step-by-Step Guide to Copy Trading on Deriv cTrader

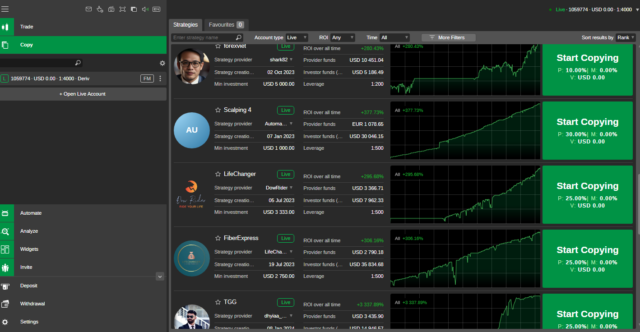

- Navigate to the Copy Tab: On the left-hand side of the cTrader platform, you’ll find the ‘Copy’ tab. Click on it to access the copy trading feature.

- Choosing a Strategy Provider: Under the ‘Strategies’ tab, you’ll find a list of strategy providers. Take your time to review their performance and select a provider that aligns with your trading preferences. You can also use the search bar to filter and find specific providers.

- Reviewing Fees and Conditions: Before committing to a strategy provider, it’s essential to review the associated fees and conditions. This includes minimum investment, performance fee, management fee, and volume fee. Hover over the information icon for detailed insights.

- Confirm Strategy Selection: Once you’ve chosen a strategy provider, select the account you want to trade from and enter your desired amount. Click the ‘Start Copying‘ button to begin replicating their trades.

- Monitoring and Reviewing: Keep track of your copied trades in the ‘Copy’ tab to stay updated on the provider’s performance and your progress. You can navigate among active copy trades and adjust your settings accordingly.

Understanding Your Fees

To provide further clarity, let’s delve into a sample fee calculation:

| Strategy Name: | Sample Strategy |

|---|---|

| Minimum Investment | $1,000 |

| Volume Fee | $5 per one million USD |

| Performance Fee | 20% of net profit using a High-Water Mark model |

| Management Fee | 5% of investor’s equity |

Volume Fee Calculation: Assuming total volume copied is $3,000,000: Volume Fee = ($3,000,000 / 1,000,000) * $5 = $15

Performance Fee Calculation: Assuming the investor’s net profit is $1,500: Performance Fee = $1,500 * 20% = $300

Management Fee Calculation: Assuming the investor’s equity is $10,000: Management Fee = ($10,000 / 100) * 5% = $50

Special Notes for Deriv Clients

- The cTrader Copy platform at Deriv offers transparent fees and strategy performance history for an informed copy trading experience.

- Strategy providers must meet minimum requirements set by the cTrader platform.

- Investors can manage their investments and risk levels with user-friendly tools and real-time data.

Disclaimer

Please note that the information provided in this blog article is for educational purposes only and should not be construed as financial or investment advice. Deriv cTrader is not available to clients residing within the European Union.

We hope this guide serves as a valuable resource for both new and experienced traders looking to explore copy trading on Deriv’s cTrader platform. Stay tuned for enriched visual aids to enhance your user experience!